This article is a sub-article of the larger article Mobile Slaughter Unit Costs and Revenues: Projections from Nevada.

Excerpted with permission from Curtis, K. R.*, M. Cowee, A. Acosta, W. Hu, S. Lewis, T. Harris. 2007. Locally Produced Livestock Processing and Marketing Feasibility Assessment. Technical Report UCED 2006/07-13: University Center for Economic Development, Department of Resource Economics, University of Nevada, Reno.

Summary

This section details start-up costs for two mobile units and a permanent fabrication facility.

All cost and revenue projections for the first year and the first five years are summarized in these two tables.

(Excel format, 1.5MB)

Mobile Unit Start-up and Operating Costs

Labor Expenses

Two employees are needed for each mobile slaughter unit to operate four distinct job responsibilities. These positions include two butchers, two assistants/drivers at approximately $25,376 a year and two plant HACCP coordinators. Both mobile slaughter units would require two butchers at an estimated yearly salary of $30,056 (Business Seminole, 2006).

The USDA Hazard Analysis and Critical Control Point (HACCP) regulation requires all slaughter and packaging facilities to develop a plan to identify critical control points for meat safety and to develop specific action plans to ensure food safety. The plant HACCP coordinator position is responsible for all meat inspection and supervisory capabilities within the plant. This position can be combined with the on-site butcher position, provided the employee has time to facilitate the necessary paperwork required by the USDA. Annual salaries are in the range of $39,940 – $56,849; a salary of $46,221 was used for this study (Career Journal, 2006). Total salaries include the estimated yearly salary, along with an estimated 15% of total salary added for taxes and benefits.

Diesel Fuel Costs

The size of the service area directly affects the fuel and maintenance costs for the mobile unit. The area of interest includes the circle between Dayton, Carson Valley, Lahontan, Smith Valley, Mason Valley and Antelope Valley. This is an area with a driving circumference of approximately 200 miles. Washoe Valley and Bridgeport add an additional round trip of approximately 40 miles. It is expected that the mobile slaughter units can potentially travel up to 220 miles each day in service and will get approximately 5 miles to the gallon.

For this study the daily traveling distance of 150 miles per day is used as the base. Diesel prices are at a national retail average of $2.82 a gallon (EIA, 2007). Calculating fuel/oil costs and maintenance, it is estimated that the 2 mobile slaughter units will cost $230.00 a day. This includes a daily fuel estimate of $200.00 ($3384/month) and an additional $30.00 a day estimated for repairs.

Offal Disposal

The livestock producer survey results show that 93% of respondents have offal disposal facilities. This analysis does not take into account offal disposal costs and assumes the waste remains on the property where the slaughter occurs.

Portable Corral Facilities

Corral facilities are needed on each farm when using the mobile slaughter unit. A majority of survey respondents (68%) do not have corral facilities available and will need to purchase five-foot portable corral facilities which range in price from $250 to $800. This expense has not been included in this analysis.

Additional Mobile Slaughter Unit Expenses

Other expenses include auto insurance, supplies, and vehicle licensing and loan principal and interest. Loan interest is assumed at a fixed rate of 9% over 10 years.

Mobile Unit Start-up Cost Summary

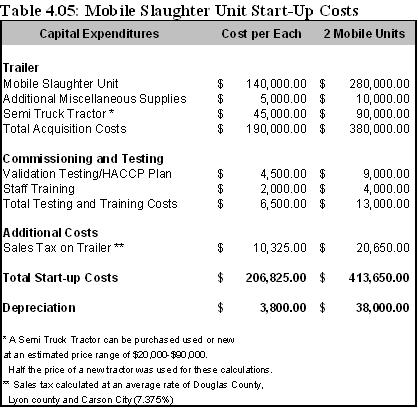

Table 4.05 itemizes acquisition and commissioning costs for each mobile slaughter unit. The price to purchase a tractor trailer varies from $20,000 – $90,000; for this study an estimated cost of $45,000 was used for the financial projections. Yearly depreciation is calculated over 10 years at an annual amount of $3,800.00.

Mobile Slaughter Unit Loan Amortization

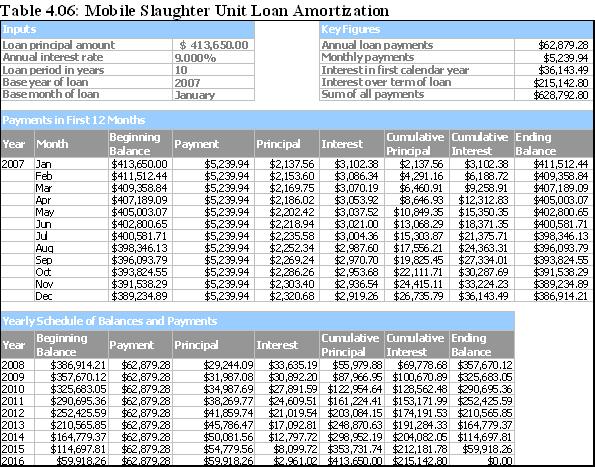

The amortization table (Table 4.06) was constructed using acquisition and start-up costs of $413,650 for the two mobile slaughter units, assuming a loan period of 10 years at 9% interest. The monthly loan principal and interest payment is $5239.94. Commercial rates of interest may change due to economic conditions.

Processing Facility Description and Location

The Process

After the mobile unit delivers the carcass to the processing facility, the carcass must be washed thoroughly. The animal’s normal body temperature must be reduced to prevent the meat from souring. This is typically done by placing the carcasses in a cooler set at -3° C (27° F) because the warm carcasses will raise the cooler temperature, providing a mean temperature of 0° C (32° F). Lower temperatures may cause cold shortening, described as an intense shortening of muscle fiber, resulting in tough meat. After 24 hours, the carcasses are moved to another cooler, where a constant 0° C (32° F) is maintained. (Meat does not freeze at this temperature.) The carcass must be stored for a minimum of seven days, although 14-21 days is more common, before it is butchered into retail portions (EPA, 1995).

Space is needed to accommodate the initial 24-hour refrigeration, extended two week storage, a viscera room, a meat cutting and processing room, and a shipping bay. Due to health concerns and USDA inspection requirements, constant hot water and power is required at the facility to maintain a sterile environment and ensure regulated refrigeration. Either a metal, pre-engineered building or a wood frame building will suffice, although interior finishes will have to be added to meet sanitation requirements.

Location

It is recommended, based on survey results, that the processing facility be located in an area of Nevada that is central to member ranches. Survey results, location of potential customers, and land costs throughout Northern Nevada indicate that the processing facility should be located in a central location, such as Silver Springs, Nevada, approximately 35 miles east of Carson City and 26 miles west of Fallon. This central location accommodates the Lahontan Valley, where 28% of respondents reside; is close to Yerington (32 miles), where an additional 13% of respondents reside; and is 51 miles from the Carson Valley, where 16% of the respondents reside.

Processing Facility Start-up Costs

Land

As of January 1, 2006, according to the USDA Agricultural Statistics Board, a measurement of the value of land in Nevada was $1,000 per acre. This represents a 15% increase from 2005 (USDA-NASS, 2006). The processing facility requires an acre of land to function.

Land improvements necessary for the facility include road access, water access, sewer lines, phone service, electricity, and natural gas. A rough estimate of $20,000 in land improvements are conditional on the location of the land purchased and its proximity to existing services.

Building

A prefabricated building can be purchased for $20 to $30 per square foot, excluding delivery, concrete work, site prep, wiring, plumbing and interior design (Sacco, 2007). This building is of steel construction and the components of steel buildings are fabricated at the factory. Steel beams, sheeting, and fasteners are delivered to the site, where the building is pieced together. Any interior work is done after the construction is complete. Additionally, snow load requirements must be considered when figuring roofing requirements. This study is estimating the need for a 10,000 square foot building, costing approximately $250,000- $300,000.

The general contractor is responsible for all permitting, architectural review, concrete foundation and the construction of the building. Estimates range from $75 to $100 per square foot to assemble. Utilizing a 10,000 square foot building, contractor fees are estimated at $1,000,000 (NCED, 2000 – Adjusted for inflation and facility size).

If chosen as the central location, the Silver Springs building requirements madate all commercial units to purchase equivalent dwelling units (EDU). All commercial operations are required to purchase 1.5 EDUs, which allow the facility to operate up to 38 sinks and toilets, at an estimated cost of $12,369.

Refrigeration units are discussed in the equipment section, but must be installed during the building process. Refrigeration costs are included in the building construction analysis, so that they may be included in the capital loan figures. Estimated building expenses are summarized as follows:

| Cost category | Assumptions | Cost |

|---|---|---|

| Contractor | $100/sf; 10,000 sf | $1,000,000 |

| Prefab building | $30/sf; 10,000 sf | $300,000 |

| Land/improvements | $21,000 | |

| Sewer fees | $12,369 | |

| TOTAL | $1,333,369 |

PLEASE NOTE: after this report was published, the authors determined a more accurate price for the processing facility building is $800,000, not $1.3 million. This will affect total costs but is not yet reflected in forecast tables.

Office Furniture and Fixtures

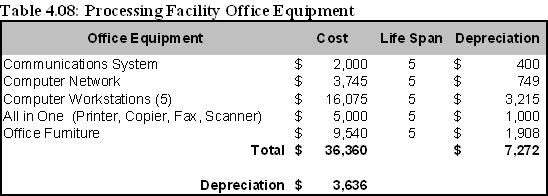

Table 4.08 lists an estimate of office furniture and fixtures (Dell.com, 2007; OfficeDepot.com, 2007; TelephoneSystems.com, 2007; CSNOfficeFurniture.com, 2007).

Refrigeration Units

The refrigerated units are prefabricated units delivered to the site directly from the manufacturer. For optimal storage, two 10 foot by 30 foot (10’x30’) refrigeration (cooler) units and one freezer unit would be required, at an approximate cost of $100,000 (Bush Refrigeration, 2007). After the meat has been cut, a freezer unit is needed for storage before the meat goes to the buyer. This approximate price includes delivery and installation.

Equipment Costs

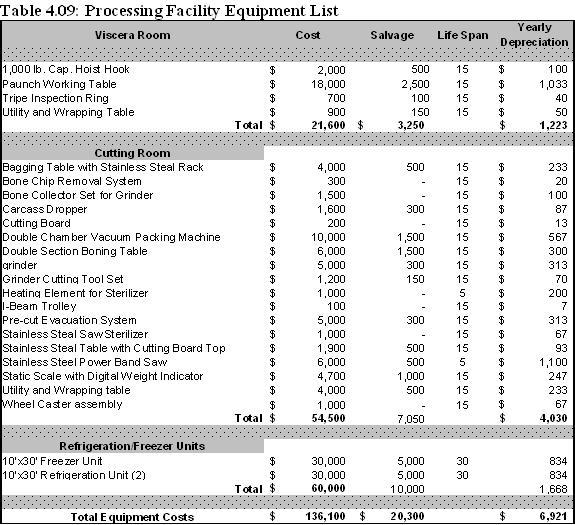

Table 4.09 details a required list of equipment for the processing facility (Center for Economic Initiatives, 2004). While used equipment is readily available, the prices listed below reflect new purchase costs. Using a percentage reduction for total capital expenses will provide a financial analysis reflecting actual costs for a combination of used and new equipment. Once purchased, a monthly expense of $100 is used to reflect replacement and repair costs.

Processing Facility Start-up Cost Summary

Table 4.10 lists the total start-up costs for the processing facility. Building expenses include the cost of material, contractor labor, refrigeration/freezer units, land improvements and sewer fees. Straight line depreciation for non-residential real property has a recovery period of 39 years which equates to $38,611 a year (IRS, 2007).

| Cost category | Cost |

|---|---|

| Building expenses | $1,333,369 |

| Furniture & fixtures | $36,360 |

| Facility equipment | $136,100 |

| Total start-up | $1,505,829 |

| Depreciation | $38,611 |

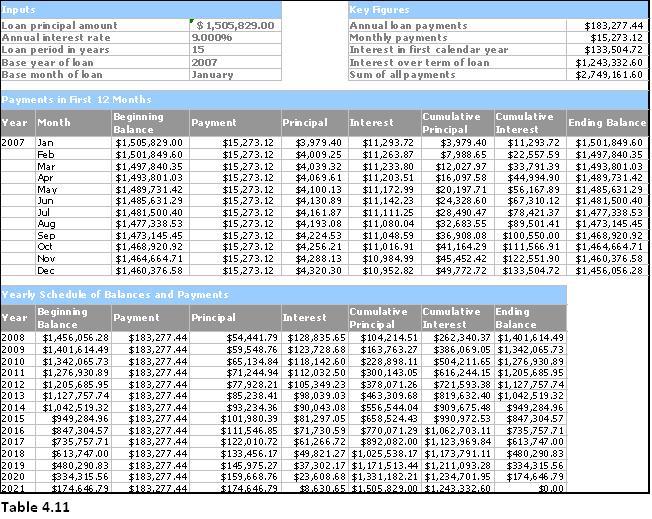

Processing Facility Loan Amortization

The amortization table 4.11, loan principal and interest amount, reflects the total start-up costs to construct and furnish the processing facility, assuming a loan period of 15 years at 9% interest. The following expenses were used: processing facility building expenses at $1,333,369; furniture and fixtures at $36,360; and processing facility equipment at $136,100.

Processing Facility Operating Costs

The financial projections show an estimate of annual income, cost of goods, and operating costs for the processing facility. Cost of goods is calculated as the price paid to the farmer; retail revenue is the price received by the processing facility. These include general expenses necessary to process the meat and distribute to retail locations. The financial statement also includes office expenses, such as telephones, office supplies and utilities, transportation and packaging expenses and maintenance and tool costs. Legal and accounting fees are also included.

Labor Expenses

Salary expenses include a full time manager/butcher, a brand/marketing product manager, an additional full time butcher and a full time office employee. Additional butchers and seasonal help will be hired as needed based on processing demand determined by the plant manager.

A plant manager usually receives a salary and full benefit package. Plant managers usually earn approximately $72,100 a year depending on size and location of the facility (Career Journal, 2007). Plant managers are usually responsible for overall operations, marketing, and member services. This position requires formal training in the agribusiness field, meat production experience, and a USDA slaughter certification. The plant manager will also be responsible for scheduling and managing the mobile slaughter units.

The brand/marketing product manager’s job is to develop and implement product marketing activities to develop brand awareness and to maximize sales. This individual should have experience marketing a product in a niche market and would report to the plant manager. The median yearly salary is $83,441 (Salary.com, 2007).

Butchers earn an annual salary between $17,000 – 42,000, depending on duration and type of experience (Career Prospects, 2007). For the financial calculations, it was assumed that one butcher would be needed. The yearly salary of $42,000 was used for the forecast.

Additional butchers usually are paid approximately $11.00 an hour, approximately $21,440 a year; benefits are optional (College Grad, 2007). Seasonal labor requires experience, but no formal education. Typical rates vary depending on location, but in Northern Nevada, labor rates are approximately $15 per hour, working an estimated 24 weeks per year.

Office staff is usually paid $12 per hour with or without benefits, which equates to a yearly salary of $24,788. The office employee should have secretarial and bookkeeping skills, although a certified public accountant (CPA) should be kept on retainer for profit distribution and tax filing. A 15% tax and benefits percentage was calculated monthly.

Insurance Estimates

The insurance estimates (given in the financial forecast tables) do not represent firm quotes. They are estimates based on the preliminary information provided for builder’s risk, worker’s compensation, business auto and trailers, general liability and business personal property, and contents for a total of $71,000 a year (ISU Stetson-Beemer Insurance, 2007).

References

- Bush Refrigeration, (2007), “Walk In Coolers and Freezers.” Online. Available at http://www.BushRefrigeration.com. Retrieved January 2007.

- Business Seminole, (2006). “Average Salary by Occupation – 2006 Estimates.” Online. Available at http://www.businessinseminole.com/ecodev/pdf/workforce_MSASelectedLaborRates.pdf. Retrieved January 2007.

- Career Journal, (2006). “Meat-and-Poultry-Company Executives at Large Companies.”. Online. Available at http://online.wsj.com/public/page/news-career-jobs.html. Retrieved January 2007.

- Career Prospects, (2007). “Butchers”. Online. Available at http://careerprospects.org/. Retrieved January 2007.

- Center for Economic Initiatives, (2004). “Plant Requirements to Set Up a Meat Processing Plant.” Online. Available at ukrainebiz.com. Retrieved January 2006.

- College Grad, (2007). “Food Processing Occupations.” Online. Available at http://www.collegegrad.com/careers/produ02.shtml#ear. Retrieved January 2007.

- CSN Office Furniture, (2007). Data collected at CSN Office Furniture website. Retrieved January 2007.

- Dell Online Store, (2007). “Servers, Storage & Networking”, “Desktops”, “Printers, Ink & Toner.” Online. Available at http://www.dell.com. Retrieved January 2007.

- Energy Information Administration (EIA), (2007). “Gasoline and Diesel Fuel Update.” Online. Available at http://www.eia.gov/. Retrieved January 2007.

- Environmental Protection Agency (EPA), (1995). EPA Report AP-42, Volume 1, Fifth Edition, Chapter 9.5.1.

- Internal Revenue Service (IRS), (2007). “Depreciation for Non-residential real property.” IRS Publication 946. Online. Available at IRS.gov. Retrieved February 15, 2007.

- ISU Stetson-Beemer Insurance, Rebecca Cullen, Commercial Account Manager. Phone: 775-823-6802, Reno, Nevada. January and February 2007.

- Nevada Commission on Economic Development (NCED), (2000). “Construction/Lease Costs, Comparison of Western Industrial Real Estate Prices.” Online. Available at http://diversifynevada.com/siteselectors/construction. Retrieved January 2007.

- Office Depot, (2007). “Furniture.” Online. Available at http://officedepot.com. Retrieved January 2007.

- Sacco, Jeremy, (2007). “Quick Guide to Choosing Prefab Buildings.” Online. http://www.buyerzone.com/industrial/portable-buildings/ar-prefab-buildings/. Retrieved January 2007.

- Salary.com, (2007). “Average Marketing Job Salary and Marketing Pay Scale, Product/Brand Marketing Manager.” Online. Available at www.salary.com. Retrieved January 25, 2007.

- Telephone Systems, (2007). “Turn-Key System Packages.” Online. Available at http://www.telephonesystems.com. Retrieved January 2007. 800-231-8726

- USDA-NASS, (2006). “Land Values and Cash Rents 2006 Summary.” Online. Available at http://usda.mannlib.cornell.edu/usda/nass/AgriLandVa//2000s/2006/AgriLandVa-08-04-2006.pdf. Retrieved January 2007.